Public hospital wait times and rising healthcare costs are affecting New Zealanders. Health insurance is now the most valued workplace benefit. Discover what’s driving this shift and how offering group health cover can help your business attract and retain top talent. In this blog, Velocity Financial Adviser Simon O'Neill explains what group health cover is, why it matters, and how it benefits business owners and their teams.

New Zealand’s public health system faces significant strain, with over 77,000 people waiting more than four months for a First Specialist Assessment (FSA) as of early 2025 (Policywise). Staff shortages—estimated at 4,800 nurses and over 1,000 midwives—are contributing to delays for diagnosis, treatment, and recovery (RNZ). Health funding remains below international benchmarks, with NZ spending 10% of GDP on health compared to an OECD average of 11.7% (NZ Medical Journal).

Group health schemes provide a practical solution for businesses to support staff health, reduce absenteeism, and boost productivity (LifeCovered, Moneybox).

.png)

A group health scheme is a private health insurance plan offered by employers to their staff, typically available to businesses with five or more employees. Employers can subsidise or fully fund premiums, and employees can often add family members. A key advantage is immediate cover for pre-existing conditions, rarely available with individual health insurance.

In the individual insurance market, pre-existing conditions are often excluded or come with long stand-down periods. With a group scheme, employees are covered immediately, even for chronic conditions like diabetes, cancer, heart disease, or joint issues.

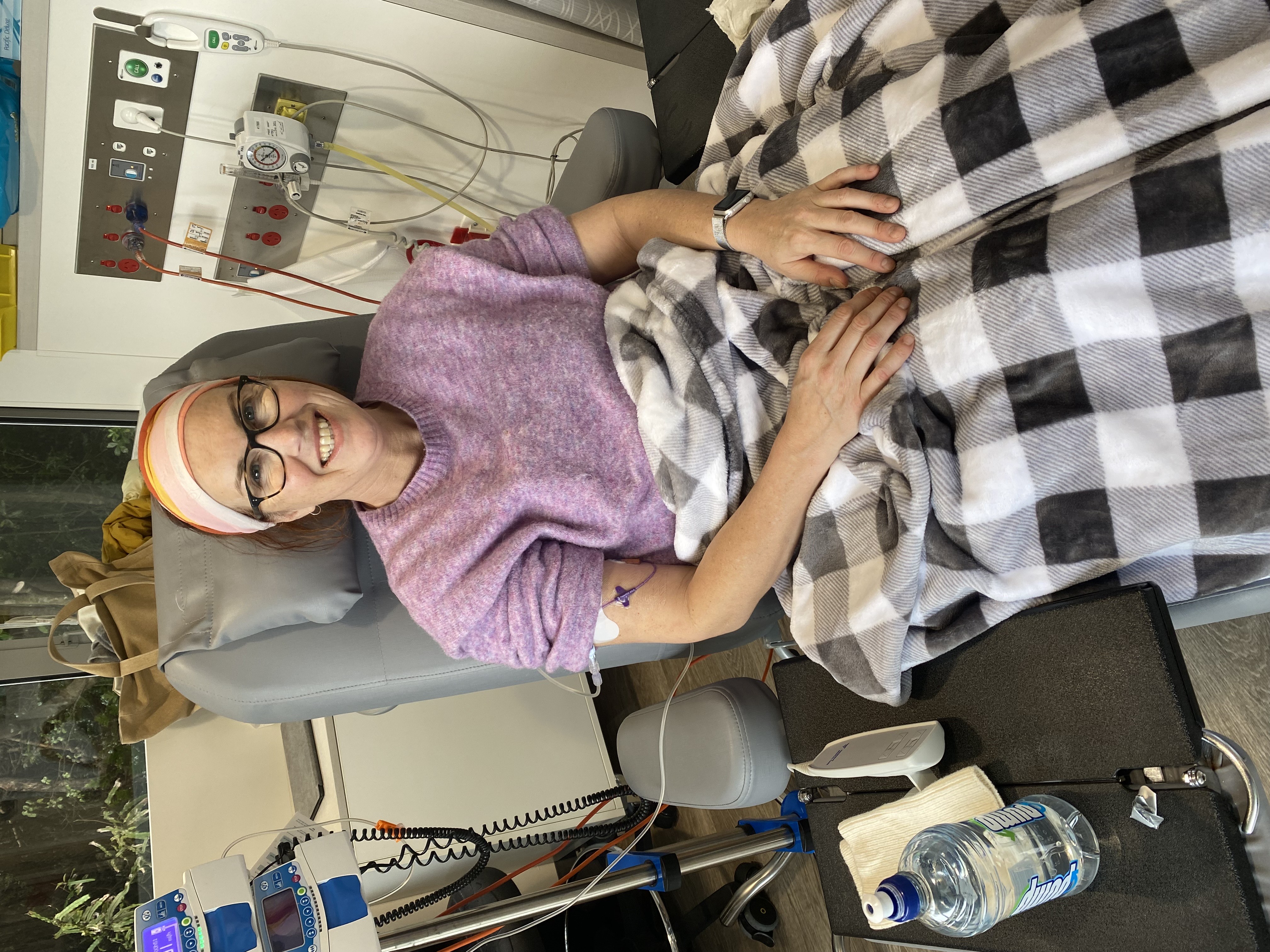

Debra’s Story:

Debra, a friend of Velocity, was diagnosed with bowel cancer. Thanks to her company’s group health scheme, she accessed urgent treatment and comprehensive follow-up care, avoiding major surgery and making a full recovery. Read Debra’s full story: I Want to Shout from the Rooftops How Grateful I Am for Health Insurance!

“As a parent, thanks to the subsidised group health scheme I can now afford specialist and tests cover for my kids, and that is a huge relief knowing they can get the care they need and not have to wait in the public system. Having pre-existing conditions covered is a major perk. My other experience going for individual insurance was not as easy, and there were several exclusions as a result. If your company offers a group health scheme, be smart and take it up!”— Shona, Velocity Financial employee

Many of New Zealand’s most progressive and people-focused businesses—across tech, finance, education, and professional services—offer group health schemes as a core part of their employee benefits (Lifetime Group, Donaldson Brown, Southern Cross).

.png)

Pricing is based on the average age and gender mix of your employees. Businesses with five or more staff can request a quote by providing basic details. Employers usually fund the premiums, while employees can pay extra to add family members.

Group health insurance premiums have risen sharply: about 12% in 2023, 13% in 2024, and a significant 33% in 2025. While general inflation is around 2.2%, medical inflation has surged to 14.5%. This is due to delayed healthcare demand post-COVID, an ageing population, and pressure on the public system. The inclusion of mental health support in policies has also increased costs (LifeCovered).

No—group health schemes are not just for large corporates.

Businesses of all sizes across New Zealand are seeing real benefits in staff retention, wellbeing, and productivity (Moneybox).

More small and medium-sized businesses are adopting group health schemes as part of their employee benefits strategy. With public wait times rising and mental health support in high demand, offering private healthcare access is becoming a key differentiator for employers.

.png)

Yes! Multiple independent surveys confirm this:

Group health schemes are a win-win for New Zealand businesses and their employees. They provide faster access to care, peace of mind, and a powerful tool for recruitment and retention. Debra’s story shows just how life-changing this benefit can be.

If you’d like to explore how a group health scheme could benefit your business and your staff, talk to me or any of our experienced financial advisers.

Another great perk of having a financial adviser on site:

Not only can we help your team with their insurance cover, but we can also support them with KiwiSaver and mortgages too. So the benefits go much further than just health cover—your staff can get expert advice on their overall financial wellbeing, all in one place.

Get in touch today to find out how we can help your business and your people thrive.

Simon.

Hi, I’m Simon a Financial Advisor here at Velocity Financial. I enjoy working with my clients to help demystify all the Mortgage, Insurance and KiwiSaver fine print, and help get them to where they want to be. I am dedicated, thorough and offer professional advice that works for you. I like to help people on their journey and be a trusted person to guide them through really important events in their lives such as the home buying process. I help my clients collaborate with valuers, builders, lawyers and real estate agents to ensure a seamless experience. That satisfaction of reaching the goal with the least amount of stress for my clients is hugely rewarding. I navigate unique scenarios and tailor lending solutions for individual circumstances to save money and time. As a proud father of two and avid supporter of all my children’s endeavours, I know just how precious that time is. On the weekends you’ll also find me mountain biking, surfing, or checking out NZ’s great walks.

Disclaimer: Simon O’Neill (FSP534466) is a Financial Adviser with Velocity Financial (FSP95466). No financial decision should be taken based on the information in this blog alone. Please see Simon’s disclosure statement on our website.

The information shared in this post is meant to be general guide to support you on your journey. When making important decisions about your finances, we encourage you to seek independent financial advice first, tailored to your unique situation. As well as talking with a financial adviser, make sure you talk to your lawyer and accountant too – together they'll help you find the best solution for your specific situation. Our knowledgeable financial advisers are here to help. Check out our website for the details about our financial advisory services in our disclosures https://www.velocityfinancial.co.nz/disclosure-statement